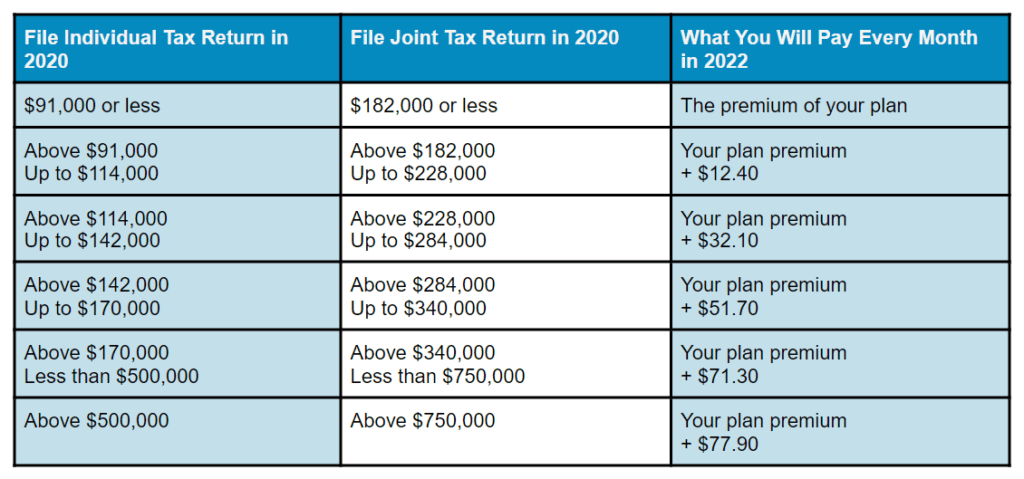

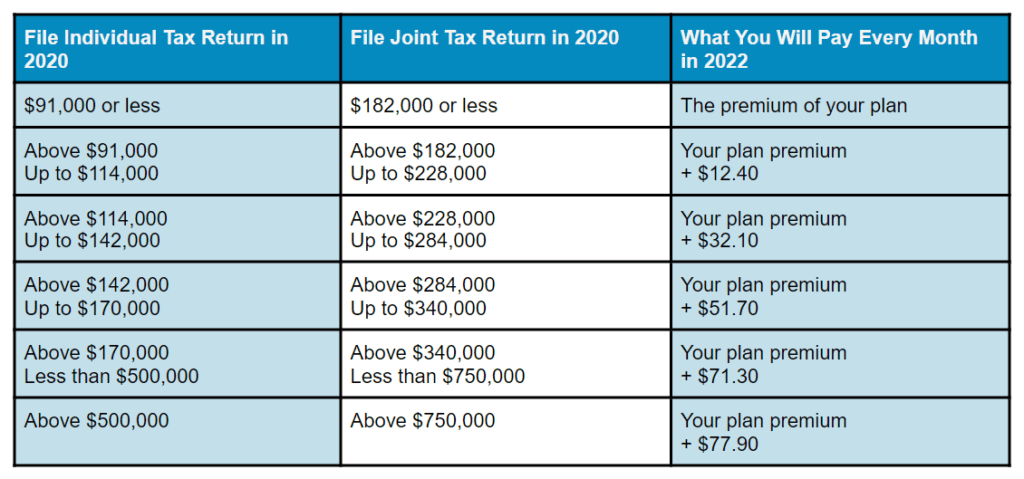

The income-related monthly adjusted amount (IRMAA) is the amount Medicare beneficiaries have to pay on their Part B and Part D premiums if their income is above a certain level. The SSA determines your IRMAA based on the earnings you report on your income tax returns from two years ago. This includes the adjusted income plus any other form of tax-exempt returns.

Cost of Part D

If you fall into a higher income bracket, here is the extra cost you may see with Part D:

How Do I Pay My IRMAA Part D?

The IRMAA for Part D isn’t part of your plan’s premium. You will have to pay this extra amount directly to Medicare, not your plan. You can have this amount deducted automatically from your Social Security or Railroad Retirement Board payments, or you can be billed by Medicare and send it through the mail. To ensure you keep your Part D coverage, you will be required to pay the IRMAA.

However, if you disagree with owing IRMAA, you have the right to file an appeal with the Social Security Administration (SSA).

Need Help Securing The Right Medicare Plan? Cornerstone Senior Advisors Is Here!

Do you need Medicare Part D coverage for your prescription drugs? Give Cornerstone Senior Advisors a call today! We will walk you through the Part D options available to you and discuss the coverage and costs with each plan.